VAT Relief

Certain items on our site are available zero rated and therefore free from VAT (Value Added Tax) at the current rate of 20%. The product description will normally state whether the product is available free from VAT, but if you'd like to check its availability, please contact our team on 020 7501 0591 who'll be happy to help.

Claiming VAT relief - at checkout

If you are eligible for VAT Relief (see below for more details), you can claim VAT relief quickly and easily while placing your order on our website. To do this, please follow the steps outlined below.

1) Select your item(s)

To start, simply add whichever products you'd like to your shopping basket.

Please note that not every product is eligible for VAT relief.

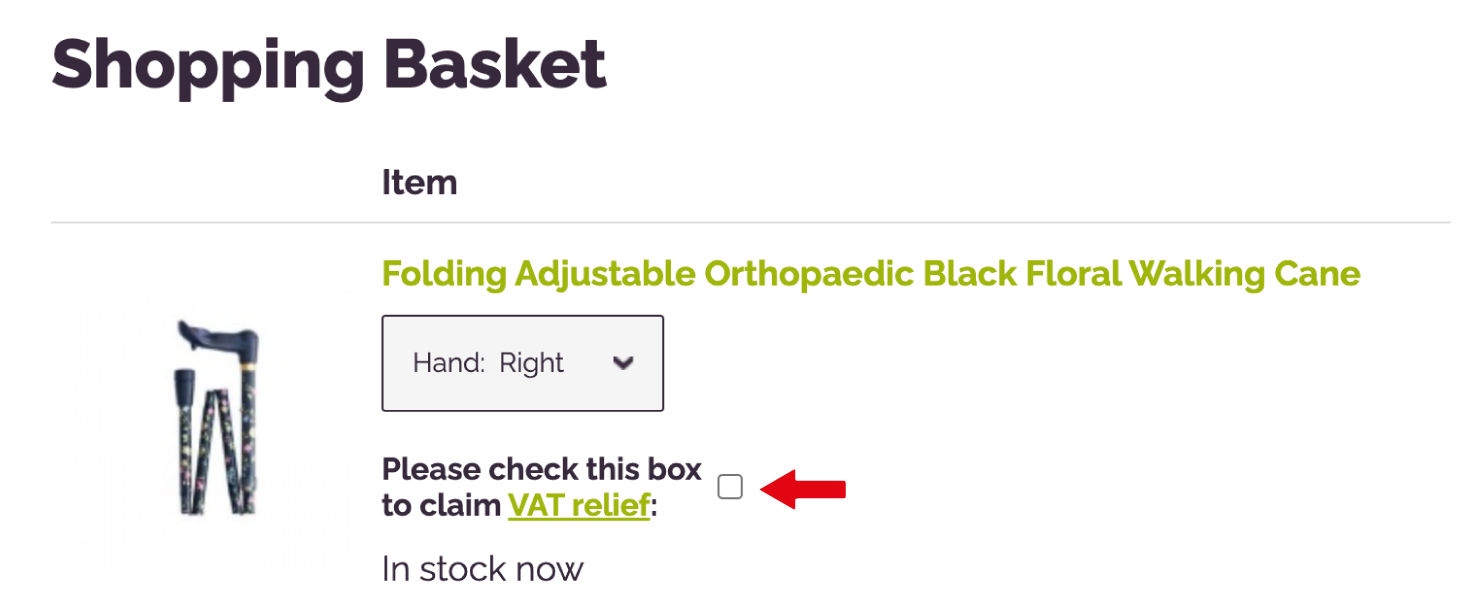

2) Select VAT relief from the basket

Once you're happy you have everything you need, you can proceed to the shopping basket. Here, underneath each product that is eligible for VAT relief, you will find a checkbox that you must select to claim VAT relief (please see the screenshot of the shopping basket below). Once this box has been ticked, the VAT will automatically be removed from this item.

Please note, if you are buying multiple items you will need to tick EACH checkbox for each item.

If a product does not have a checkbox, it is currently not eligible for VAT relief.

3) Complete our VAT Relief Form during checkout

Once you've selected your items and confirmed that you would like VAT relief, you can continue to the checkout. After entering your personal and delivery details, you will then be directed to a page featuring a form to complete in order to claim VAT relief. Once this form is completed, simply continue to the payment page and place your order.

Please note, this process may differ slightly if checking out via PayPal.

Please take care when completing the VAT form, as errors or missed fields can delay the processing of your order.

Claiming VAT relief - after placing your order

If you've placed an order without claiming VAT relief during the checkout process, you are still able to make the claim afterwards. To do this, please fill in the VAT exemption form below.

You are able to do this by either filling in the fields of the form below, or by downloading and printing off the VAT relief form in paper form, completing it and sending it to us.

We would recommend filling in the electronic form below as it is quicker and easier to complete than printing off, completing and return the paper form to us.

Please only submit either the electronic form (recommended), or the postal form. There is no need to submit both.

Alternatively, please print out this form:

Please post it to the following address:

Walking Sticks

Unit 6, Union Court

Union Road

London

SW4 6JP

We will process the electronic or postal form upon receiving it, and we will make a refund of VAT to your account, normally within 3 working days.

Please only submit one form to us (electronically or via the post). There is no need to submit an electronic and postal VAT relief form.

If you have already successfully claimed VAT at checkout, please do not submit an electronic or postal VAT Relief Form.

You are able to check that VAT relief was applied successfully at checkout by reviewing the invoice sent to you by email.

If you have any questions about this process at any time, or would like further guidance, please contact our team. We will be happy to help: Contact Us

Who can claim relief from VAT?

If you are disabled or have a chronic medical condition, you are eligible to claim relief from VAT. There is no need to register with HM Revenue and Customs. Simply fill in the VAT Relief form and send it to us at the above address.

A detailed explanation of the rules surrounding who is eligible to claim relief from VAT is available from the HM Revenue and Customs website. The document can be found here. The reference for this document is Notice 701/7 (August 2002).

Can I claim VAT relief on behalf of someone else?

Yes, however the person you're claiming on behalf of must be disabled or have a chronic medical condition in accordance with the guidance notes available on the HM Revenue and Customs website. When claiming on behalf of another, please state your name and phone number along with the name of the person you are claiming for. Please complete the electronic form above (recommended) or click on the link below, and complete and return the VAT Relief Form to us by post.

VAT Relief FormHow will the VAT be refunded?

The way that VAT will be refunded depends on the method you use to claim VAT relief. When buying items from our website, the full amount including VAT will be charged.

Please complete and return the VAT Relief form to us. As soon as we receive the form, we will process the information, and a refund of the VAT you've been charged will be refunded to your account. This is normally processed within 3 business days.

If you have any queries about the refund, or the amount to be refunded, please contact our team on 020 7501 0591.

How much will be refunded?

The full 20% VAT will be refunded on each item, subject to a completed and eligible VAT Relief claim, and will be calculated as follows:

Example 1 : An item is £120.00 on our website (inclusive of VAT). This is the purchase price for that item.

- This £120.00 is calculated as the price of the item exclusive of VAT (£100.00) plus 20% VAT, bringing the VAT inclusive total of the item to £120.00.

- Once we receive your VAT Relief form, we'll refund the difference between the price exclusive of VAT and the price inclusive of VAT.

- £120.00 - £100.00 = £20.00. The total refunded will be £20.00 (the 20% VAT that was paid on the item).

Example 2 : An item is £100 on our website (inclusive of VAT). This is the purchase price for that item.

- This £100 is calculated as the price of the item exclusive of VAT (£83.33) plus 20% VAT, bringing the VAT inclusive total of the item to £100.

- Once we receive your VAT Relief form, we'll refund the difference between the price exclusive of VAT and the price inclusive of VAT.

- £100.00 - £83.33 = £16.67. The total refunded will be £16.67 (the 20% VAT that was paid on the item).